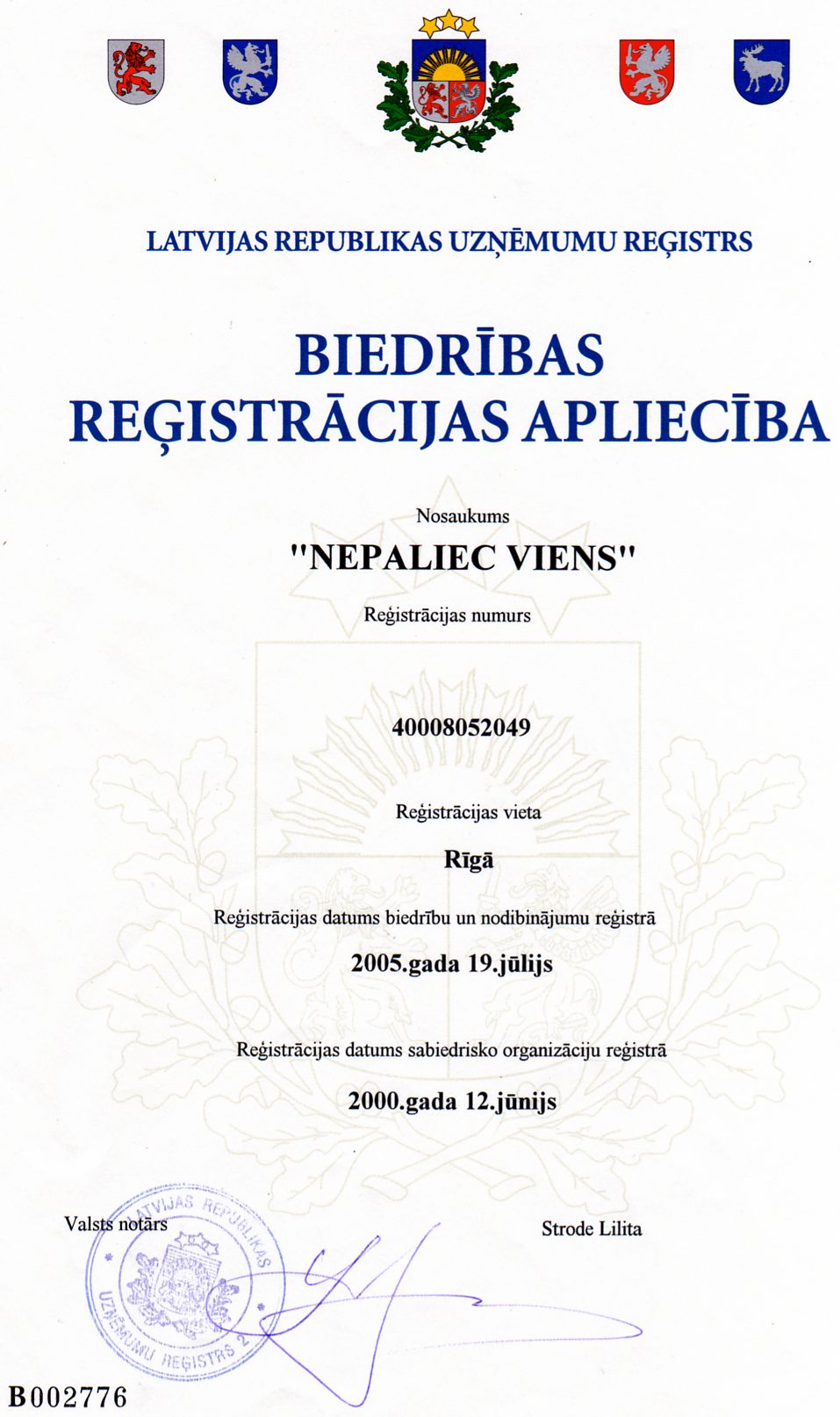

About “Nepaliec Viens” (Don't Stay Alone)

Non profit organization "Nepaliec Viens" activities is aimed at to promoting social participation, development of civil society, provide support to socially vulnerable persons, childrens, young people, adults with special needs (physical and mental disabilities) and the retirement age for people who need it. The association organizes and participates in various competitions, charity events, concerts, travel, and other activities that are not contrary to Christian morality.

Our goals:

-

support and organize activities for socializing and integrating people into society,

-

support and organize activities for strengthening families and for responsible parenting.

Our scopes:

- promotion of social welfare,

- promotion of health improvement,

- educational activities,

- promotion of emotion consciousness,

- collection of donations in accordance with the principles of charity,

- involve persons, companies and their available resources for social and charity activities.

Nepaliecviens.lv (until 2013 also known as Bildēs par Dzīvi / Life in Snapshots) also reflects the significant and positive messages about socially significant developments in Latvian and beyond, - tells the story of the people and groups of people who need some help and for people or societies, which takes care of the necessary assistance.

For proposals and feedback, please contact to us:![]() vestule (@) nepaliecviens.lv

vestule (@) nepaliecviens.lv ![]() +371 29473896

+371 29473896

Bank: A/S Swedbank, account: LV17HABA0551019137811

Donation purpose: implementation of activities

Public benefit status: Nr.79. 29.05.2008 VID SLO catalog

Donation purpose: implementation of activities

Bank: A/S Swedbank, account: LV20HABA0551044676402

Donation purpuse: implementation of activities

Mērķis: Aktivitāšu īstenošanai vai cits mērķis

Bank: A/S Swedbank, accoun: LV17HABA0551019137811

Donation purpuse: implementation of activities

Companies in Latvia (until to 31.dec. 2017) may reduce the taxable income of the donor amounts pursuant to the provisions of Article 8.2, but the overall reduction in taxable income must not exceed 10 percent of taxable income.This is determined by the law "On corporate income tax".

Bookmark made by youth of Gaismas school.

Reproduction or distribution content of NepaliecViens.lv must be agreed in advance and adding an reference: Association “Nepaliec Viens”, www.nepaliecviens.lv

send message | twitter: NepaliecViens | facebook: NepaliecViens | telegram: NepaliecViens